Loading...

4th December 2023

US mega-cap stocks, most notably ‘The Magnificent Seven’ Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla have performed extremely well this year. We have avoided these names all year, a decision which, with the benefit of hindsight, was a mistake – mea culpa. As we are now heading towards a new year it is natural to reappraise this decision and to consider what the prospective risks and returns of these stocks look like now.

To avoid any unnecessary suspense, both our bottom-up stock specific and top-down macroeconomic analysis suggests at least five of the seven look to be uncomfortably expensive. In the context of the macroeconomic situation the valuations of this cohort, we think, could reasonably be described as being in a bubble. In the original 1960’s movie, four of The Magnificent Seven heroes failed to survive the final shootout. We do not expect anything as dramatic for The Magnificent Seven stocks, but we do anticipate some substantial bumps and bruises ahead. And we do see a risk that one of the seven will not make it into the sequel.

The long-run average trailing Price/Earnings ratio of stocks in the S&P 500 has typically been around 16. A P/E ratio of 16 implies an earnings yield of 6.25%. This is approximately 1 to 2% higher than the yield currently available from U.S. money markets or long-term government bonds. Historically the spread has been higher, however, as we may be close to a cyclical high in interest rates the historic figure of 16 would seem to be a reasonable valuation benchmark.

![]()

An alternative, arguably better benchmark, is to compare earnings yields to the yields available on long term U.S. government inflation linked Treasury bonds. As both earnings yields and TIPS yields are real (after inflation) yields, this is a fairer comparison. Currently long-term TIPS are offering a yield of approximately 2.1% above inflation. Therefore, a stock trading at a P/E ratio of 16 would enjoy a 4% risk premium to TIPS. We believe this to be close to a normal risk premium, suggesting the pricing of bond markets are consistent with an equilibrium P/E ratio of around 16.

A simple average P/E ratio of The Magnificent Seven, based on their trailing earnings per share, shows these companies trading at 45 times earnings. This is an earnings yield of just 2.2%, suggesting no risk premium relative to the supposedly risk-free Treasury market. Holding high-risk stocks while low-risk Treasuries are available offering very similar prospective returns is not likely to be a stable equilibrium.

Correcting this valuation anomaly back toward historic norms could come about in a number of ways. Real bond yields could fall but only a modest downward adjustment seems possible for this variable. Alternatively, the drama-free adjustment would require robust earnings growth over the coming few years while the high-drama adjustment would involve something close to a 66% decline in these equity values.

The consensus expectations of the analyst community is for the benign adjustment where earnings grow into the current valuations. The analyst community expects The Magnificent Seven to grow earnings sufficiently to bring next year’s P/E ratio down to about 32. This would take the earnings yield up to 3.2%, at which point, the seven would then have an 1% equity risk premium to TIPS of 1%. This would be an improvement, but it would still require a few more years of robust growth to bring valuations back to normal.

We will come to the macroeconomic indicators in a moment, but first it is worth considering the individual components of The Magnificent Seven. Two of the five, Alphabet and Meta, stand out as trading on relatively modest P/E ratios of 24 and 21 respectively, while not cheap these valuations do not warrant any particular attention. Apple and Microsoft are trading on what could be considered stretched multiples of 31 and 36 times earnings respectively. More worryingly Amazon, Nvidia and Tesla look still more precarious at 69, 60 and 77 respectively. Incidentally, an analysis of free cash flow yields, an alternate value metric, paints a similar if not more extreme picture.

Analysts are optimistic Amazon and Nvidia will enjoy very strong earnings growth next year taking their multiples down to 33 and 24 respectively. But for Tesla even the ebullient analyst community expects its multiple to remain stuck at an eye watering 67 times earnings. For reference Toyota, trades at a multiple of just 10. Across a range of metrics Tesla looks to be 7 to 8 times more expensive than Toyota. On this basis an 80% share price decline would bring Tesla into equilibrium with its competitors.

Both Tesla and Nvidia have benefited from rapid growth in recent years and the stock market has reward them with these extremely high valuations. As a direct consequence of those valuations, it has become possible for a range of companies to gain funding to compete with Tesla and Nvidia. Tesla is already suffering from this competition, being forced to cut prices while losing market share. Nvidia may come under similar pressure in coming years. It is one of the perennial challenges for Technology investors that high multiples imply reliance on hypothetical distant future earnings while the rapid pace of innovation together with the funding attracted by those multiples frequently undermine the margins of those future earnings.

Turning now to the macroeconomic outlook. Market consensus has settled on expecting a soft-landing scenario whereby economies avoid recessions because inflation falls fast enough to allow the policy makers to reverse the recent cycle of interest rate hikes, fast enough to avoid a significant slowdown in consumer and investment spending. The first steps of this script are already playing out with inflation falling back from its post-pandemic surge and bond markets starting to price interest rate cuts in the first half of the new year. So far, the all-important US economy has remained more resilient in the face of the Fed’s rate hiking cycle than was widely expected, probably due to households having built up a reserve of savings during the enforced austerity of lockdown years, in addition President Biden’s Inflation Reduction Act has also provided a powerful stimulus package. The risk is that consumers may have drained their reserves – some high-profile US retailers have sounded notes of caution in this earnings season – and this year’s fiscal thrust could turn into next year’s fiscal drag. If so, next year we may be facing the delayed effect of prior interest rate hikes just as these supportive factors are waning.

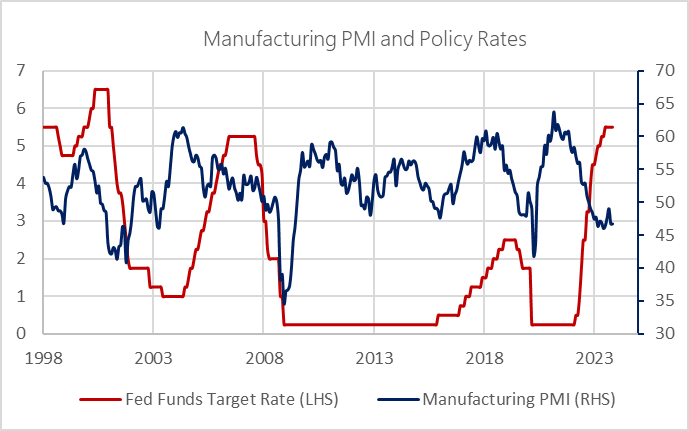

Supporting this more cautious prognosis, a number of the more reliable macroeconomic activity indicators are suggesting an economic slowdown is already underway. The ISM Manufacturing purchasing managers index (see above) has fallen from a 2021 peak of 63.8 to a contractionary 46.7. In the past similar sharp falls in the PMI preceded or were coincident with sharp interest rate cutting cycles in 2001/2002, following the bursting of the Millenium Nasdaq bubble, in 2007/2008 during the global financial crisis and in 2019/2020 during lockdown. In each of these cases the rate cutting cycle was associated with recessions and abrupt declines in the stock market. Today’s soft-landing narrative has the Federal Reserve deftly anticipating the forthcoming slowdown and preventing it with pre-emptive rate cuts. This has not been the pattern in the previous three cycles where declines in the stock market have tended to coincide with or anticipate a weakening economy causing policymakers to react, after the fact, by cutting interest rates.

In 2000 the interest rate hiking cycle continued well into the period when the PMI and the stock market was already flagging a slowdown. Prior to that cycle the stock market had, like today, reached irrationally exuberant valuations. As a consequence, the subsequent NASDAQ bear market lasted two years, culminating in an eventual peak to trough loss of 78%. The similarity between that period and the current period both from a macroeconomic and valuation perspective gives us pause for thought.

Ordinarily we like to let our investments be guided by market momentum. This has the benefit of drawing on the wisdom of crowds while producing a reassuringly fashionable portfolio of investments that is easy on the eye. Occasionally, however, the wisdom of crowds turns to a mania of crowds and that mania can switch direction violently. We believe the valuation of The Magnificent Seven, and a few other technology stocks have become a mania. The mania may yet go further; however, we believe on a risk adjusted basis, it is unwise to follow the crowd at this time.

Fortunately, one of the side effects of the mania is there is another cohort of deeply unfashionable stocks which are now trading on abnormally attractive valuations. We humans take comfort in being part of the consensus which makes it emotionally extremely difficult to hold these unfashionable investments. Nevertheless, we believe being uncomfortably unfashionable is today’s big opportunity.

***

To join our distribution list, please send ‘subscribe’ to: info@Equitile.com

Disclaimer:

These materials contain preliminary information that is subject to change and is not intended to be complete or to constitute all the information necessary to adequately evaluate the consequences of making any investment. This document is being provided solely for informational purposes. The value of an investment may fall or rise. All investments involve risk and past performance is not a guide to future returns. Equitile offers no guarantee against loss or that investment objectives will be achieved. Equitile does not offer investment advice. Please read the Key Investor Information Document, Prospectus and any other offer documents carefully and consult with your own legal, accounting, tax and other advisors in order to independently assess the merits of an investment. Investors and any potential investors should be aware of local laws governing investments and should read all the relevant documents including any reports and accounts and scheme particulars as appropriate. The State of the origin of the Fund is the United Kingdom and the Fund is authorised and regulated by the UK Financial Conduct Authority. This document may only be distributed in or from Switzerland to qualified investors within the meaning of Art. 10 Para. 3, 3bis and 3ter CISA. In Switzerland, the Representative is ACOLIN Fund Services AG, Affolternstrasse 56, CH-8050 Zürich, whilst the Paying agent is Aquila & Co. AG, Bahnhofstrasse 28a, CH – 8001 Zurich. In respect of the units distributed in Switzerland, the competent Courts shall be at the registered office of the Representative in Switzerland. The Basic documents of the Fund as defined in Art. 13a CISO as well as the annual and, if applicable, semi-annual reports may be obtained free of charge at the office of the representative. Equitile Investments Ltd is authorised and regulated by the UK Financial Conduct Authority.

Hedonism and the value of money - Part I

2

Hedonism and the value of money - Part I

2

Dollar Demise?

2

Dollar Demise?

2

Investment Letter - Eternal Adaptation

2

Investment Letter - Eternal Adaptation

2

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

An Impossible Trinity?

2

An Impossible Trinity?

2

Inflation Really is Caused by Governments - Some thoughts from '74

2

Inflation Really is Caused by Governments - Some thoughts from '74

2

Facts not Opinions

2

Facts not Opinions

2

Barney's P Curve - Why we expect higher inflation

2

Barney's P Curve - Why we expect higher inflation

2

No Hard Promises - thoughts on inflation after COVID-19

2

No Hard Promises - thoughts on inflation after COVID-19

2

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

Are Central Banks Causing Stagflation?

2

Are Central Banks Causing Stagflation?

2

When Science Fails

2

When Science Fails

2

Jubilee - A time for borrowers to celebrate?

2

Jubilee - A time for borrowers to celebrate?

2

Artificial Intelligence - Scary Good

2

Artificial Intelligence - Scary Good

2

Crisis Economics

2

Crisis Economics

2

Debt & the magical mathematics of Brahmagupta

2

Debt & the magical mathematics of Brahmagupta

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Modern Monetary Theory - The Magic Money Tree

2

Modern Monetary Theory - The Magic Money Tree

2

0

0

Hedonism and the value of money - Part II

2

Hedonism and the value of money - Part II

2

The Anxiety Machine - The end of the world isn't nigh

2

Register for Updates

12345678

-2

The Anxiety Machine - The end of the world isn't nigh

2

Register for Updates

12345678

-2