Loading...

6th June 2022

The Year of Jubilee

8 Count off seven sabbath years—seven times seven years—so that the seven sabbath years amount to a period of forty-nine years.

9 Then have the trumpet sounded everywhere on the tenth day of the seventh month; on the Day of Atonement sound the trumpet throughout your land.

10 Consecrate the fiftieth year and proclaim liberty throughout the land to all its inhabitants. It shall be a jubilee for you; each of you is to return to your family property and to your own clan.

11 The fiftieth year shall be a jubilee for you; do not sow and do not reap what grows of itself or harvest the untended vines.

12 For it is a jubilee and is to be holy for you; eat only what is taken directly from the fields.

13 In this Year of Jubilee everyone is to return to their own property.

14 If you sell land to any of your own people or buy land from them, do not take advantage of each other…

23 …The land must not be sold permanently, because the land is mine and you reside in my land as foreigners and strangers.

24 Throughout the land that you hold as a possession, you must provide for the redemption of the land.

25 If one of your fellow Israelites becomes poor and sells some of their property, their nearest relative is to come and redeem what they have sold.

26 If, however, there is no one to redeem it for them but later on they prosper and acquire sufficient means to redeem it themselves,

27 they are to determine the value for the years since they sold it and refund the balance to the one to whom they sold it; they can then go back to their own property.

28 But if they do not acquire the means to repay, what was sold will remain in the possession of the buyer until the Year of Jubilee. It will be returned in the Jubilee, and they can then go back to their property.

Britain has just finished celebrating the 70th anniversary of Queen Elizabeth II ascending to the throne. Villages, towns, and cities across the country have been decorated with bunting, street parties held, and concerts performed. After the two years of lockdown the celebrations have come as a welcome relief. The photo above shows The Mall with Buckingham Palace in the background the morning after the first day of celebrations. The photo below shows the decorations in the little Surrey village of Shere, once famous as the holiday destination of Cameron Diaz, and more recently as the location of Equitile’s Surrey office. Our chief executive often wanders the streets of Shere, but has yet to bump into Ms. Diaz.

The idea of a ‘Jubilee’ celebration has an interesting etymology going back to Old Testament scripture. Leviticus 25 – see above – says a jubilee should be held the year after seven times seven years have elapsed, that is every fifty years. These fifty-year biblical jubilee celebrations were associated with debt forgiveness and a return of previously sold property to its original owners: “if they do not acquire the means to repay, what was sold will remain in the possession of the buyer until the Year of Jubilee. It will be returned in the Jubilee, and they can then go back to their property.”

The idea of a ‘Jubilee’ celebration has an interesting etymology going back to Old Testament scripture. Leviticus 25 – see above – says a jubilee should be held the year after seven times seven years have elapsed, that is every fifty years. These fifty-year biblical jubilee celebrations were associated with debt forgiveness and a return of previously sold property to its original owners: “if they do not acquire the means to repay, what was sold will remain in the possession of the buyer until the Year of Jubilee. It will be returned in the Jubilee, and they can then go back to their property.”

The idea of debt jubilees or debt forgiveness survives into modern economic thinking. In America the Biden administration is reported to be considering a limited debt jubilee of student loans.

Despite the compelling arguments for student debt forgiveness, all debt jubilees suffer problems of fairness and adverse incentives. By definition, a loan is a contract between at least two parties. If one side is allowed to walk away from their debt the loss must be borne by the other party. Similarly, if a debt jubilee is anticipated there will be an incentive for borrowers to incur excessive debt and perhaps to fail to service their debt even if they would be able to do so. These issues could in turn discourage economically useful lending activity and push up borrowing costs unnecessarily.

The problem of adverse incentives would be pronounced if it were easy to anticipate the timing and nature of a debt jubilee. It is difficult to see how, for example, a regular 50-year jubilee could be made to work without causing lending activity to grind to a halt ahead of the jubilee. As a result, the economy would likely suffer a wrenching boom-bust cycle coincident with the jubilee cycle. This is perhaps why the predictable 50-year biblical debt jubilees, if they were ever implemented, have not survived into modern times.

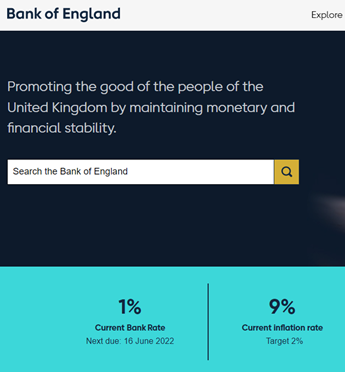

Predictable debt jubilees may be unworkable but there are other, more subtle, ways to engineer debt forgiveness.  The panel to the right, taken from the Bank of England’s website, shows the current base interest rate together with the inflation rate in the U.K. Savers are currently getting paid close to 1% interest on their deposits (for many it is lower). However, due to inflation, the real purchasing power of savings is falling by 9% per year. Savers are therefore suffering an 8% annual loss of purchasing power. On the other hand, those who borrow are enjoying an 8% decline in the real value of their debt over a year. The current high inflation rate has been largely unanticipated, and therefore is not being matched by higher interest rates. The upshot is a rolling debt jubilee erasing approximately 8% of the real value of debt each year.

The panel to the right, taken from the Bank of England’s website, shows the current base interest rate together with the inflation rate in the U.K. Savers are currently getting paid close to 1% interest on their deposits (for many it is lower). However, due to inflation, the real purchasing power of savings is falling by 9% per year. Savers are therefore suffering an 8% annual loss of purchasing power. On the other hand, those who borrow are enjoying an 8% decline in the real value of their debt over a year. The current high inflation rate has been largely unanticipated, and therefore is not being matched by higher interest rates. The upshot is a rolling debt jubilee erasing approximately 8% of the real value of debt each year.

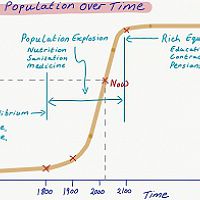

Queen Elizabeth’s 70-year reign is a useful to time to consider how inflation can, over long periods, amount to an almost total debt jubilee. The Bank of England has a handy online tool to help show inflation between different time periods – Bank of England Inflation Calculator – which reports average U.K. inflation at 4.5% in the last 70 years. This official 4.5% rate of inflation means today you need £20.23 to purchase what £1 would have bought in 1952. Put differently, according to the Bank of England, in real terms, a loan taken out in 1952 would now be worth just 5% of its face value. Borrowers would have enjoyed a cumulative 95% debt jubilee on the notional value of their debt.

The Bank of England’s official 4.5% inflation rate is a tricky thing to calculate. Many of the products we buy today did not exist in 1952 and many others have changed substantially over the years. As a result, most of today’s prices are not directly comparable with those 70 years ago. Statisticians attempt to compensate for these changes by adjusting price changes to take into account changing product quality and consumption patterns. Newspapers are one product that have remained somewhat comparable over long periods and, usefully, tend to have uniform pricing. Newspapers therefor provide a useful sense check for the official inflation numbers.

Prior to 1971, Britain used a complicated monetary system in which one pound was worth twenty shillings, one shilling was worth 12 pence. To add to the confusion, one pence was abbreviated to 1d. Therefore, £1 was worth 240d.

In 1952 the Daily Mirror newspaper cost 1.5d. Which is 1.5/240 of a pound or 0.625 pence in today’s decimal monetary system. If the Bank of England’s 4.5% estimate of annual inflation, since 1952, is correct today’s Daily Mirror should cost 13.6pence.

Below we show a randomly selected recent front page of the Daily Mirror with its current price of £1, more than 7 times greater than it should be, according to officially recorded inflation.

Over the last 70 years the price of the Daily Mirror has risen from 0.625 pence to 100 pence. This price change equates to an average compound inflation rate of approximately 7.5% over the last 70 years, significantly above the official 4.5% figure from the Bank of England’s website. Of course, this is just one possible pricing benchmark, but if it is representative then today’s reported 9% inflation rate may be closer to 15% in practice.

Over the last 70 years the price of the Daily Mirror has risen from 0.625 pence to 100 pence. This price change equates to an average compound inflation rate of approximately 7.5% over the last 70 years, significantly above the official 4.5% figure from the Bank of England’s website. Of course, this is just one possible pricing benchmark, but if it is representative then today’s reported 9% inflation rate may be closer to 15% in practice.

A recent government report “Public spending during the Covid-19 pandemic” reports the current spending on Covid-19 related measures as being between £310 to £410 billion or somewhere between £4,600 to £6,100 per person. Recouping these amounts from the private sector economy though higher direct taxation would be politically difficult and would likely trigger a recession, and perhaps even a debt-deflation cycle.

On the other hand, if the government were to permit inflation to continue running, significantly above interest costs, for a number of years, the result would be a debt jubilee by stealth. We suspect this is the most practical and politically expedient policy path from the current situation.

The Old Testament idea of a predictable 50-year debt jubilee does not work, but its modern counterpart, an unpredictable rolling inflationary debt jubilee may be more successful.

At the moment, an inflationary debt jubilee appears to be in the interest of governments, but governments will not be able to inflate away their own debt without doing the same for others. Therefore, now may be a good time for private investors to follow the lead of government and begin increasing their use of leverage.

***

To join our distribution list, please send ‘subscribe’ to: info@Equitile.com

0

0

Facts not Opinions

2

Facts not Opinions

2

Build a company on prudence and trust, not debt

2

Build a company on prudence and trust, not debt

2

When Science Fails

2

When Science Fails

2

2016: A Tale of Two Walls

2

2016: A Tale of Two Walls

2

Can fair fees make active managers more sustainable?

2

Can fair fees make active managers more sustainable?

2

Lumbering corporate dinosaurs face mass extinction

2

Lumbering corporate dinosaurs face mass extinction

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

An Impossible Trinity?

2

An Impossible Trinity?

2

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

The Anxiety Machine - The end of the world isn't nigh

2

The Anxiety Machine - The end of the world isn't nigh

2

Revolutionary Fervour

2

Revolutionary Fervour

2

Luddites and the New Social Revolution

2

Luddites and the New Social Revolution

2

In Search of Stability & Growth - If only Europe was more like the US

2

In Search of Stability & Growth - If only Europe was more like the US

2

A creditable recovery

2

A creditable recovery

2

Going Rome - Both football and monetary policy are heading south

2

Going Rome - Both football and monetary policy are heading south

2

Stock market superstars and the danger of a buy-and-hold investment strategy

2

Stock market superstars and the danger of a buy-and-hold investment strategy

2

Tales of an Astronaut - Lessons from the Unknown

2

Tales of an Astronaut - Lessons from the Unknown

2

Investment Letter - Constant Reformation

2

Investment Letter - Constant Reformation

2

Why ownership matters more than ever

2

Why ownership matters more than ever

2

Regulating Psychopaths

2

Regulating Psychopaths

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

When Prophecy Fails - How to ignore doomsday forecasts

2

When Prophecy Fails - How to ignore doomsday forecasts

2

Revival of the Fittest

2

Revival of the Fittest

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

Barney's P Curve - Why we expect higher inflation

2

Barney's P Curve - Why we expect higher inflation

2

Public Deficits, Private Profits

2

Public Deficits, Private Profits

2

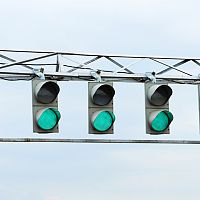

Still Flashing Green: Equities in a world of higher growth and financial repression

2

Register for Updates

12345678

-2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

Register for Updates

12345678

-2