Loading...

29th September 2020

Will the COVID-19 lockdowns prove deflationary or inflationary? Will they add to or erode the future spending power of money? This is a question we have been debating over the last few months.

Will the COVID-19 lockdowns prove deflationary or inflationary? Will they add to or erode the future spending power of money? This is a question we have been debating over the last few months.

So far, evidence suggests, the lockdowns have been modestly deflationary. Since the start of the year, inflation in the Eurozone has fallen from 1.3% to -0.2% year-on-year, while U.K. inflation has fallen from 1.3% to 0.2% and in the U.S. from 2.3% to 1.3%. Given the restrictions imposed on normal economic activity, a near term reduction in demand, resulting in downward pressure on prices, was to be expected. The longer-term impact on prices is less clear.

Most major economic crises cause a deterioration in household finances but, in many economies, the COVID-19 lockdown has had the opposite effect. The combination of generous government furlough schemes together with lower household expenditures have allowed many households to increase their savings rates. In the U.S., for example, personal savings as a percentage of disposable income, surged from a normal level of around 7.5% prior to the lockdown to a peak of 34% in March. Since then it has fallen back to around 18% but still shows households are, on average, benefitting financially from the COVID-19 crisis.

The accumulation of private sector savings remains a strong reason to anticipate a post-lockdown spending spree with the potential to reinvigorate inflationary pressures. Acting in the opposite direction is the prospective future rise in unemployment, which may prove substantial and long lived. Here in the U.K., the government is now in the process of reducing furlough payments and at the same time implementing a new secondary lockdown. If, as we expect, these policies cause a sharp rise in redundancies, the hoped-for post-lockdown spending spree may fail to materialise, allowing deflationary forces to gain the upper hand. On balance, we now expect unemployment to dominate accumulated savings leading to an extended period of weak private sector demand. That said, we are more interested in the consequences of future government spending than private sector spending. From a financial perspective the COVID-19 crisis has been dominated by a surge in government deficit spending. We believe the magnitude, duration and efficiency of future government deficit spending will determine the path of inflation over coming years.

To illustrate how the efficiency of future government spending could influence inflation, it is informative to do a back-of-the-envelope estimate of the value for money governments have got from their economic lockdowns. For convenience, we will use the U.K. figures to make the point, although we expect the conclusions will be similar in the other countries that have chosen to lock down their economies.

As with all government healthcare spending, the purpose of the lockdown has been to reduce or, more correctly, delay deaths. The standard way to compare the effectiveness of different types of healthcare spending is through assessing the number of additional Quality Adjusted Life Years – QALYs – achieved by the spending. In the U.K. the National Institute for Healthcare Excellence, NICE, is responsible for determining which health treatments the government is willing to fund. They do so by estimating the treatment’s cost per QALY. The following passage is taken from the NICE website:

Quality-adjusted life year (QALYS)

A measure of the state of health of a person or group in which the benefits, in terms of length of life, are adjusted to reflect the quality of life. One QALY is equal to 1 year of life in perfect health.

QALYs are calculated by estimating the years of life remaining for a patient following a particular treatment or intervention and weighting each year with a quality-of-life score (on a 0 to 1 scale). It is often measured in terms of the person’s ability to carry out the activities of daily life, and freedom from pain and mental disturbance.

Elsewhere on their website NICE explain they work to an upper threshold of between £20,000 to £30,000 per QALY when assessing whether or not to fund any particular medical treatment: “the current standard NICE cost-effectiveness threshold range of £20,000 to £30,000 per QALY”. However, research in 2015, reported that the British National Health Service outperforms this upper threshold by delivering one additional quality adjusted life year for each £13,000 of NHS spending. Allowing for five years of inflation we will take the pre-COVID-19 cost of a QALY as £15,000.

According to the Office for National Statistics, ONS, who produce a daily update of the COVID-19 statistics 41,988 patients have died in the U.K. within 28 days of testing positive for the COVID-19 virus, as of 27th September. The current population of the U.K. is estimated at 67 million, giving a COVID-19 related fatality rate of approximately of 0.063%. (Note: this is a population fatality rate, not a case fatality rate.)

Knowing the number of COVID-19 related deaths in the U.K. does not help assess the cost per QALY of the U.K.’s economic lockdown. To make that calculation, it is necessary to estimate the counterfactual, that is: the number of COVID-19 related deaths that would have occurred in the absence of an economic lockdown. Of course, the true number of COVID-19 related deaths that would have occurred without an economic lockdown can never be known, the best we can do is make an educated guess at the number.

Sweden famously chose not to implement an economic lockdown and to date has suffered a cumulative total of 5,896 COVID related deaths out of a population estimated to be 10.1 million. That equates to a death rate of 0.058%, close to, but slightly below, the death rate in the UK. By contrast Spain’s lockdown policies have been amongst the toughest. To date Spain has reported 31,232 deaths in a population of 47 million, giving a fatality rate of 0.07%. For Italy the figures are 35,835 fatalities in a population of 60.5 million, giving a fatality rate of 0.06%. While Germany is an outlier, reporting only 9,534 fatalities out of a population of 83 million giving a fatality rate of just 0.01%.

The similarity between fatality rates between Sweden, UK, Spain and Italy despite wildly different lockdown strategies suggests the lockdowns may have had little or no impact on the spread of the disease. If so, the COVID-19 lockdown policies will fall into that special class of policy mega-mistakes, the consequences of which are too grave to acknowledge and therefore too big to discuss.

Since the Swedish data suggests such an unpalatable value assessment for the U.K. lockdown we will, for illustrative purposes, ignore it and instead assume the U.K’s lockdown have successfully cut number of fatalities by 50%. That is, we will assume as many lives have been saved by the lockdown as have already been lost to the virus. For ease of calculation, and to be a little more generous to the policy, we will round up the number and assume 50,000 lives have been saved. (If you prefer a different figure, it is not difficult to work it through the following calculations.)

Using the latest ONS data, showing the breakdown of COVID-19 deaths by age group, we estimate the average age of a COVID-19 victim to be approximately 79 years. Rather helpfully, the ONS also has a handy online life expectancy calculator which, if you input your sex and age, tells you how long you are expected to live. According to the ONS life expectancy calculator an average 79-year-old should expect to live another 9 years.

We know most COVID-19 victims had other pre-existing co-morbidity conditions suggesting the average COVID victim is not as healthy as the wider population. If so, 9 years of lost life per COVID fatality is most likely a significant overestimate, additionally those lost years would not have been lived in full health and therefore not count as full QALYs So, for our purposes, we will assume the lockdown has saved 5 QALY for each life presumed to have been saved. This gives us an estimate of 250,000 QALYs saved by the lockdown: 50,000 lives at 5 QALYs each.

The next step is to estimate how much those 250,000 QALYs cost. Helpfully, the National Audit Office provides an online running total of the cost of the government’s COVID-19 measures. Up until the start of August the COVID-19 Cost Tracker reported a running total of £210 billion spent on the lockdown. We can safely assume that figure has already risen and will continue rising for years to come, as a consequence of elevated future unemployment. For ease of calculation, we will be very conservative, and assume a total cost of £250 billion, although we will be surprised if the final bill is not more than twice this figure and perhaps four times as high if costs to the private sector are fully accounted for.

A price of £250 billion for an estimated 250,000 quality-adjusted life years conveniently works out at a cost of £1,000,000 per QALY. (Recall, to get to this figure we have assumed 50,000 lives saved, while the Swedish data suggest the true number could be as low as zero, and that is without going into the question of QALYs lost due to the cessation of, for example, cancer treatments during lockdown).

As discussed earlier, prior to the COVID-19 lockdown the government was paying, via the NHS, £15,000 per QALY. Therefore, the QALYs purchased with lockdown policies are 67 times more expensive than those ordinarily provided by the NHS.

We estimate the government’s lockdown policy has caused 6,700 percent inflation in healthcare costs, in less than a year. In all probability this is a significant underestimate.

It is possible to challenge each and every assumption used to reach this estimation, but one would have to make some heroic alternate assumptions to avoid reaching a similar conclusion.

The COVID-19 crisis might be causing mild disinflation in the private sector, but in public sector spending it is causing hyperinflation.

The question of why governments have been willing to spend such vast sums for such poorly costed and hypothetical gains will doubtless trouble historians for decades to come. We are not going to attempt an exhaustive answer to this question, but we will offer a couple of hints as to where to look. Modern Monetary Theory and the Precautionary Principle are two ideas which have been gaining traction in policy making circles over recent years. These ideas share an important feature in that they both each encourage policy action without thought to the consequences of that action.

Modern Monetary Theory tells governments they do not need to balance their books, they do not need to constrain their expenditure to match the tax they collect. With this mindset governments were able to embark on lockdown without even a cursory costing exercise, safe in belief they could print the money to pay the bill. Modern Monetary Theory is technically correct: governments can and, we expect, will print money to pay the bill. But Modern Monetary Theory does not take account of how such fiscal freedom will influence the quality of government spending decisions. Over time, as we believe has happened with the lockdown, the absence of budgetary constraint will diminish the quality of government purchasing decisions.

The Precautionary Principle is, if anything, even less well thought out than Modern Monetary Theory. The Precautionary Principle, or as we prefer the Panic Principle, is the idea that when faced with a potentially catastrophic risk every effort should be made to avoid that risk. Superficially this appears a reasonable argument. On closer inspection it is anything but reasonable. The flaw in the logic is that it takes no account of the risks associated with the precautionary action. We may, for example, use the Precautionary Principle to argue against the use of nuclear energy: the small risk of a catastrophic nuclear explosion is such that nuclear energy should be avoided at all costs. However, if the failure to use nuclear energy causes global warming through greater use of fossil fuels the victory could be Pyrrhic.

In the case of the lockdown we took drastic actions to avoid hypothetical unmeasurable risks without giving thought to tangible quantifiable costs: how many QALYs would be lost due to the denial of other medical services during the lockdown? By how much will the health services be underfunded in future years as a result of COVID-19 costs?

Both Modern Monetary Theory and the Precautionary Principle are, in a literal sense, irresponsible ideas. They both encourage policymakers to set policy without taking responsibility for the consequences of those policies. The longer-term consequences of such ideas are, in our view, likely to be a decreasing value for money from government spending decisions – otherwise known as inflation.

If you would like to join or leave our mailing list please drop us a line at info@Equitile.com ?

No Hard Promises - thoughts on inflation after COVID-19

2

No Hard Promises - thoughts on inflation after COVID-19

2

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

Revival of the Fittest

2

Revival of the Fittest

2

Is corporate debt addictive?

2

Is corporate debt addictive?

2

Regulating Psychopaths

2

Regulating Psychopaths

2

COVID-19: Our initial response and thoughts

2

COVID-19: Our initial response and thoughts

2

Norway Moves to America - Mean reversion and industrial revolutions

2

Norway Moves to America - Mean reversion and industrial revolutions

2

Hanging the Wrong Contract?

2

Hanging the Wrong Contract?

2

Monetary Policy on a War Footing

2

Monetary Policy on a War Footing

2

Luddites and the New Social Revolution

2

Luddites and the New Social Revolution

2

Modern Monetary Theory - The Magic Money Tree

2

Modern Monetary Theory - The Magic Money Tree

2

Tales of an Astronaut - Lessons from the Unknown

2

Tales of an Astronaut - Lessons from the Unknown

2

A creditable recovery

2

A creditable recovery

2

Investment Letter - Constant Reformation

2

Investment Letter - Constant Reformation

2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

0

0

The Anxiety Machine - The end of the world isn't nigh

2

The Anxiety Machine - The end of the world isn't nigh

2

Stock market superstars and the danger of a buy-and-hold investment strategy

2

Stock market superstars and the danger of a buy-and-hold investment strategy

2

Build a company on prudence and trust, not debt

2

Build a company on prudence and trust, not debt

2

Hedonism and the value of money - Part I

2

Hedonism and the value of money - Part I

2

The Consequences of COVID-19

2

The Consequences of COVID-19

2

An Impossible Trinity?

2

An Impossible Trinity?

2

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

Revolutionary Fervour

2

Revolutionary Fervour

2

Brochure

1

Brochure

1

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Facts not Opinions

2

Facts not Opinions

2

Hedonism and the value of money - Part II

2

Hedonism and the value of money - Part II

2

In Search of Stability & Growth - If only Europe was more like the US

2

In Search of Stability & Growth - If only Europe was more like the US

2

Lumbering corporate dinosaurs face mass extinction

2

Lumbering corporate dinosaurs face mass extinction

2

Crisis Economics

2

Crisis Economics

2

While Stocks Last - Reflections on the share buyback debate

2

While Stocks Last - Reflections on the share buyback debate

2

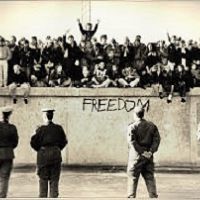

2016: A Tale of Two Walls

2

2016: A Tale of Two Walls

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Register for Updates

12345678

-2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Register for Updates

12345678

-2