Loading...

21st July 2020

There is nothing more dangerous than an excess of caution

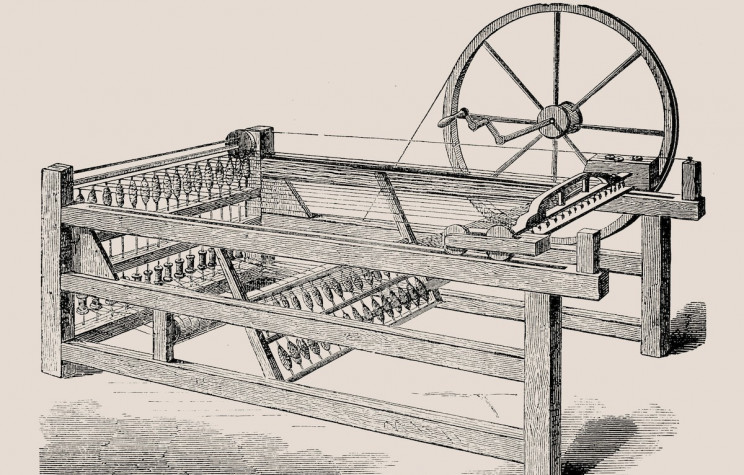

In the early 19th century, when industrial spinning and weaving machines were helping start the first phase of the industrial revolution, a counterrevolutionary movement known as the Luddites, emerged in Nottingham, England. The Luddites, fearing the new machinery would put them out of work, took to sabotaging the newly invented machines. Today ‘Luddite’ is a term of derision for someone who holds back progress by resisting new technology or working practices. It has become a term of derision because, we now know those early cloth making machines were part of a general process of mechanisation and industrialisation which lifted the living standards of humanity to levels unimaginable in the early 19th century. Nevertheless, the Luddites had a point. The purpose of technological progress is to increase efficiency, and when technological progress is unusually rapid large numbers of people find their livelihoods are threatened.

In the early 19th century, when industrial spinning and weaving machines were helping start the first phase of the industrial revolution, a counterrevolutionary movement known as the Luddites, emerged in Nottingham, England. The Luddites, fearing the new machinery would put them out of work, took to sabotaging the newly invented machines. Today ‘Luddite’ is a term of derision for someone who holds back progress by resisting new technology or working practices. It has become a term of derision because, we now know those early cloth making machines were part of a general process of mechanisation and industrialisation which lifted the living standards of humanity to levels unimaginable in the early 19th century. Nevertheless, the Luddites had a point. The purpose of technological progress is to increase efficiency, and when technological progress is unusually rapid large numbers of people find their livelihoods are threatened.

It looks increasingly likely the Covid19 economic lockdown is helping dramatically accelerate another phase of the industrial revolution. Mechanical spinning and weaving machines helped transform a cottage industry of individuals, working largely alone in their own homes, into a centralised industrial process conducted in large factories. The process of replacing inefficient spinning wheels with more efficient spinning Jennies helped accelerate the urbanisation process, dispersed rural workers became centralised city-workers. Over the last two centuries mechanisation, industrialisation and urbanisation worked hand in hand transforming both the economy and society. The economic lockdown of the last few months has forced many of us out of our centralised, city-based offices, to work remotely from our dispersed homes. The remote working revolution could be the start of, at least partially, reversing the urbanisation process.

Equitile’s experience of remote working has been surprisingly positive. We certainly miss the face-to-face contact with our colleagues and clients, but video conferencing has proven surprisingly effective at mitigating this loss. On the other hand, none of us are missing the daily face-to-face contact with hundreds of strangers on crowded trains, tubes and busses. Judging from conversations we have with others and the public announcements of much larger organisations, our positive experience of remote working is commonplace.

The economic lockdown has forced many city-centre based companies to experiment with remote working and broadly the experiment has been a success. Some of the lockdown restrictions are now being eased but there is little evidence of a sudden rush back to the office. Many companies have announced their intention to voluntarily continue working remotely for most of the rest of the year or even into the new year. Doubtless this reluctance to return to the office is being exacerbated by requirement to wear facemasks in public places, including public transport and shops, which in recent weeks has become the norm in many places.

It is likely authorities and business owners who are mandating facemasks on public transport and in shops are hoping the measures will give people the confidence to return to their previous way of life. We suspect the face masks will have the opposite effect. Face masks on public transport sends a clear message: continue commuting to the office over the internet, using Microsoft Teams. Face masks in shops sends an equally clear message: keep shopping on Amazon. To the many people who have had a positive experience of remote working and remote shopping, the imposition of facemasks is enough of a reason to keep the remote working experiment going. For this reason, and of course because of the ongoing threat of having lockdown re-imposed due to secondary waves of infection, there seems little prospect that office occupancy will return to normal levels anytime soon.

The lockdown has already been long enough to become habit forming both for individuals and for companies. We expect the introduction of facemasks on public transport and in shops will effectively extend the economic impact of lockdown until the end of the year. This, we believe, is long enough to cause significant, irreversible, economic change. Much of that change we expect to be positive, but some will, in the short term, be negative.

For businesses, we believe the lockdown is the economic equivalent of you holding your breath. You can hold your breath safely for a few seconds, but if you do so for a few minutes you start to suffer irreversible harm. We were told originally that lockdown would last only long enough to prevent healthcare systems from being overwhelmed. That lead us to expect a brief lockdown lasting a few weeks. We thought the economy could hold its breath for a few weeks and afterward would quickly bounce back with a robust V-shaped recovery. The goal now appears to focus on a much longer-term suppression of the virus, including the prevention of possible secondary waves of infection. As a result, the measures have lasted months instead of weeks and many larger companies, especially those in the travel, tourism and hospitality sectors are clearly already suffering irreversible harm; announcements of mass layoffs and bankruptcies have become a daily occurrence. We expect smaller companies will be suffering even greater harm, although they generally attract less press coverage. With four months of mandated monetary hypoxia behind us and several more to come we must now brace ourselves for an accelerating wave of business failures and redundancies.

From an economic perspective, we believe, the decision to try to lift the economic lockdown gradually, allowing different types of businesses to open at different times, is a mistake. An economy is not a collection of separate individual businesses. Rather it is a collection of interlocking co-dependent businesses. At any one time, a city has almost exactly the right number of sandwich shops, restaurants, bars, theatres, hotels and hairdressers to service the typical number of office workers, factory workers, care workers, tourists and students etc. Each business has developed, in an economic ecosystem, in balance with the rest of the economy. If a major element of the economy is disrupted the whole of the ecosystem must adapt to maintain balance. We fear the staged lifting of the lockdown will cause many re-opening businesses to fail as they find their operating costs return long before their customers. If large numbers of office workers are now going to work remotely, on a full or even a part-time basis, the economic ecosystem of city centres will need to adapt significantly. The commercial districts of cities will need fewer offices, shops, restaurants, gyms and bars. Some of the employment provided by these city-centre companies will migrate to wherever the remote workers are – we will still need the same number of haircuts, regardless of where we work. Other jobs will be lost entirely – presumably, remote workers will need far fewer cellophane wrapped sandwiches and barista-prepared coffees.

On the positive side, remote working looks likely to be a windfall gain for the work-life balance of millions of people and, with less business-related travel, for the planet also. On the negative side, we are likely to see a sudden downward adjustment in the demand for city-centre real estate. Cities will eventually adapt to this change, but with fewer occupants, rental yields and therefore asset prices will likely have to adjust significantly lower to attract new tenants. Many of the industries who have been worst affected by the lockdown – travel, tourism, entertainment and hospitality – are labour intensive and therefore large employers, suggesting we should anticipate a substantial increase in unemployment.

The epicentre of the 2007-2009 global financial crisis was the U.S. residential real estate market and the associated mortgage backed bond market. The financial epicentre of the Covid19 crisis could easily become the commercial real estate market and its associated credit markets, including bank financing. Fortunately, household demand is not as closely linked to the commercial real estate market as it is to the residential market. Nevertheless, losses in commercial real estate may lead to a general tightening of lending standards and rising unemployment will present a headwind to any recovery in household spending. As a result, the much discussed, V-shaped recovery, which we believed was possible just two months ago, now looks untenable. The lockdown has lasted too long, is being lifted in too piecemeal a manner, and remote working has proven too successful to allow the economy to bounce back to its original state with a V-shaped recovery. We believe the post-lockdown economy is going to be very different to the pre-lockdown economy with large sections of the economy permanently changing their business practices.

If we are correct and this new phase of the industrial revolution is going to send large numbers of workers back into their homes, the investment implications will be profound. Companies helping facilitate these new working practices will thrive while those reliant on the old practices will fall by the wayside. Value investors will need to be especially careful. Basing investment decisions on yesterday’s yields derived from yesterday’s economy may steer them toward a portfolio of cheap spinning wheels just when everyone is switching to the more expensive, more productive, spinning Jennies. That is an oblique way of saying we are expecting the new high-tech virtual-economy sectors to continue outperforming the old low-tech physical-economy sectors.

One thing that is very different about today’s revolutionary environment, to that experienced by the Luddites, is the existence of unemployment benefits and social security programs. Over coming years governments are going to be forced to step in to provide a safety net for those who find themselves unemployed due to the abrupt economic change. Years of higher social security payments, on top of the unprecedented bill for furlough and other payments during the lockdown, will test many governments’ finances beyond their normal breaking point. We are expecting the demands on government expenditure to go well beyond what can be accommodated with the normal fiscal tools of higher taxation and lower expenditure – otherwise known as austerity. Attempting to fund the lockdown and its aftermath through austerity will likely turn a recession into a depression. For this reason, we expect many governments will resort to monetised deficit spending. Put bluntly, we expect governments to try to print their way out of their fiscal problems. Three important factors push in this direction: firstly, political populism is on the rise making austerity practically untenable for many democracies; secondly, many within the central banking community now fear deflation more than inflation, and are therefore likely to support deficit spending enthusiastically; thirdly, the newly fashionable Modern Monetary Theory provides a thin, but sufficient, veneer of academic respectability for monetised deficit spending. We expect future generations will view the Covid19 lockdown as marking the turning point from a four-decade long period of disinflation and relative monetary stability to a similarly multi-decade period of inflation and monetary instability. In our view, the first symptoms of this monetary debasement are already becoming manifest in the rising price of gold.

This brings us to the question of the outlook for stock markets broadly. Ordinarily a period of high structural unemployment and credit concerns might suggest a weak stock market. But these are far from ordinary times. It is worth remembering an asset price is simply an exchange rate between the value of the asset and the value of money. Normally the asset’s value is volatile while money’s value is relatively stable. Therefore, most of the changes in an asset’s price can be attributed to changes in its value. However, in periods of monetary debasement, the real value of money can fall quickly. As a result, an asset’s price may rise due entirely to monetary effects. In extreme circumstance it is possible for asset prices to rise even as their true or ‘real’ value is declining. We are confident there are enough good companies, who will benefit from the shift to an increasingly virtual economy to generate attractive investment returns in both nominal and real terms. But these companies are, we think, still a small minority of those listed on the wider stock market.

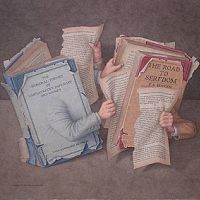

We advise investors with substantial portfolios of nominal assets such as cash and bonds to study previous periods of monetary debasement carefully. The Lords of Finance by Liaquat Ahamed or The Moneymaker by Janet Glesson both provide excellent lessons in this area.

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

Brochure

1

Brochure

1

How we invest

1

How we invest

1

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

Facts not Opinions

2

Facts not Opinions

2

Fair Fees

1

Fair Fees

1

An Impossible Trinity?

2

An Impossible Trinity?

2

0

0

2016: A Tale of Two Walls

2

2016: A Tale of Two Walls

2

'Fixing Economics' by George Cooper: Book Review

2

'Fixing Economics' by George Cooper: Book Review

2

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

Crisis Economics

2

Crisis Economics

2

Regulating Psychopaths

2

Regulating Psychopaths

2

Is it time to rethink monetary policy?

2

Is it time to rethink monetary policy?

2

Can fair fees make active managers more sustainable?

2

Can fair fees make active managers more sustainable?

2

A creditable recovery

2

A creditable recovery

2

Revival of the Fittest

2

Revival of the Fittest

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

Invest in Resilience

1

Invest in Resilience

1

Build a company on prudence and trust, not debt

2

Build a company on prudence and trust, not debt

2

Debt & the magical mathematics of Brahmagupta

2

Register for Updates

12345678

-2

Debt & the magical mathematics of Brahmagupta

2

Register for Updates

12345678

-2