Loading...

3rd December 2020

Print Article Read Article (with Chinese translation)

“Workers spend what they get, capitalists get what they spend.”

Attributed to Michal Kalecki, 1899-1970

Economic lockdowns have pushed government debt levels dramatically higher. For years economists have warned of the risks of excessive government debt. But economics is a flexible science always able to rationalise a political necessity and, right now, higher current and much higher future debt levels are a political necessity. In a timely paper – A Reconsideration of Fiscal Policy in the Era Low Interest Rates – the economists Jason Furman and Lawrence Summers have begun the process rationalising much higher future government borrowing:

Economic lockdowns have pushed government debt levels dramatically higher. For years economists have warned of the risks of excessive government debt. But economics is a flexible science always able to rationalise a political necessity and, right now, higher current and much higher future debt levels are a political necessity. In a timely paper – A Reconsideration of Fiscal Policy in the Era Low Interest Rates – the economists Jason Furman and Lawrence Summers have begun the process rationalising much higher future government borrowing:

“…in a world of unused capacity and very low interest rates and costs of capital, concerns about crowding out of desirable private investment that were warranted a generation ago have much less force today. We argue that debt-to-GDP ratios are a misleading metric of fiscal sustainability that do not reflect the fact that both the present value of GDP has risen and debt service costs have fallen as interest rates have fallen. Instead we propose that it is more appropriate to compare debt stocks to the present value of GDP or interest rate flows with GDP flows.”

The present value of future GDP, discounted at today’s ultra-low interest rates, is much higher – incalculably higher – than current GDP, therefore this proposed new metric of the debt burden provides enough flexibility to excuse any amount of future government borrowing.

As professional equity investors, we are enthusiastic supporters of fiscal deficits. On the other hand, as responsible citizens and parents we are rather less enthusiastic about their longer-term social consequences. It is fair to say, on the topic of government deficits, we suffer a degree of cognitive dissonance and that dissonance has become much worse this year. In this note we explain why fiscal deficits are good for equity investors.

Gross Domestic Product, GDP, is a measure of the size of an economy. The two most common methods of calculating GDP are known as the ‘expenditure method’ and the ‘income method’. The expenditure method simply adds up all spending that occurs in an economy, in a given time period. The income method adds up all sources of income, in the same period. Since one person’s expenditure is another’s income, in theory, the tallies of income and expenditure should come to the same number.

GDP by expenditure can be divided into: private sector consumption, government spending, investment spending, and net exports:

GDP by expenditure = consumption + investment + government spending + (exports – imports)

GDP by income can be divided into: rent, interest, profit, wages. These incomes are usually measured before tax, but for our purposes it is more useful to work with after tax incomes and to break out the government’s tax income explicitly:

GDP by income = rent + interest + profits + wages + tax

Since these equations measures of the same GDP number:

GDP by expenditure = GDP by income

consumption + investment + government spending + (exports – imports) = rent + interest + profits + wages + tax

The above identity can now be rearranged to help explain how changes in spending or incomes in one area of the economy might affect those of another. One possible rearrangement is to put all sources of the returns to capital on one side and everything else on the other:

profits + interest + rent = (consumption - wages) + (government spending – tax) + (exports – imports) + investment

This relationship is the basis of the quotation at the start of this article, attributed to the Polish economist Michal Kalecki. It shows, if consumption is in balance with wages, (consumption = wages), and government spending is in balance with its tax takings, (government spending = tax), and exports are in balance with imports, (exports = imports), then the return on capital collapses to a single term:

profits + interest + rent = investment

Hence: the return on capital is the same as investment spending or: “capitalists get what they spend.”

Strictly speaking, Kalecki’s phrase should be: If workers spend what they get, capitalists will get what they spend, provided governments also spend what they get and foreign trade is in balance.

Another alternative arrangement puts only profits on the left-hand side and everything else on the right:

profits = (consumption - wages) + (government spending – tax) + (exports – imports) + (investment – interest – rent)

This arrangement is known as the Kalecki profit equation , although strictly speaking it is an identity.

The profit equation helps explain why the stock markets bounced back so strongly in response to this year’s the stimulus programs.

Furlough schemes shifted a large part of the corporate wage bill from the ‘wages’ term to the ‘government spending’ term. This allowed the ‘consumption’ term to rebound quickly. As a result, both ‘(consumption – wages)’ and ‘(government spending – tax)’ were boosted causing a rise in profits. In aggregate, companies could still sell their goods without having to give their workers as much money to pay for them, hence the rise in profits (clearly not for all firms).

Kalecki liked to analyse the economy by drawing a sharp divide between payments to capitalists and payments to workers. This has the unfortunate effect of giving his writings something of a Marxist tone. That said, his equation demonstrates the validity of this distinction. If a government suddenly increases its deficit spending, and workers do not have the pricing power to demand a share of that spending, the path of least resistance is for the deficit spending to flow either into domestic corporate profits or, through the trade term, into foreign corporate profits. In 2020 the rising deficits have been too large and too global to be absorbed in foreign trade and have therefore been absorbed primarily through driving up household savings and boosting corporate sector profits. We expect much of the money accumulated in the form of higher household savings is parked there only temporarily before it also finds its way into corporate profits.

This brings us to our cognitive dissonance: As investors in equities we like deficit spending because, as explained, it boosts corporate profits and therefore boosts the value of the companies we invest in. However, as citizens, we have a more nuanced view. The Kalecki profit identity helps explain why, contrary to accepted wisdom, government deficits often increase rather than decrease wealth inequality within society. Indeed, it is not much of a stretch to say a central bank’s balance sheet, which effectively now act as a record of accumulated government deficits, are a reasonable metric of wealth polarisation driven by monetary policy. As an aside, this is why we also think those who have bought into the ideas of Modern Monetary Theory, expecting them to lead to a more equitable world, have been sold a pup.

Having explained how government deficits can inflate corporate profits it would be remiss if we did not add a note of caution. Implicit in Kalecki’s equation is a warning about what happens when governments try to reverse their deficits and begin repaying their debts. If this happens the ‘(government spending – tax)’ term will turn negative and almost certainly cause a contraction in corporate profits. In this situation, picking the right companies will become even more important than it is today. That said, we expect governments will continue accumulating deficits. In our view, the ideas of Modern Monetary Theory are now sufficiently popular in the corridors of power to keep the deficit spending flowing for some years to come.

We suspect the borrowing of 2020 has already pushed government debt levels across the Rubicon into a realm where the only practical endgame is for central banks to effectively write-off the debt. If this happens then what has been sold as a reversible quantitative easing will, in effect, become an irreversible de-facto monetisation. In which case the deficits will have, in large part, been a windfall to equity investors.

If you would like to join our mailing list please send us a message at info@Equitile.com

Investment Letter - Eternal Adaptation

2

Investment Letter - Eternal Adaptation

2

Norway Moves to America - Mean reversion and industrial revolutions

2

Norway Moves to America - Mean reversion and industrial revolutions

2

No Hard Promises - thoughts on inflation after COVID-19

2

No Hard Promises - thoughts on inflation after COVID-19

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Revolutionary Fervour

2

Revolutionary Fervour

2

Revival of the Fittest

2

Revival of the Fittest

2

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

Monetary Policy on a War Footing

2

Monetary Policy on a War Footing

2

The unspoken political truth about debt

2

The unspoken political truth about debt

2

Facts not Opinions

2

Facts not Opinions

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

A creditable recovery

2

A creditable recovery

2

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

0

0

Lockdown: What did we get? Why did we do it?

2

Lockdown: What did we get? Why did we do it?

2

Hanging the Wrong Contract?

2

Hanging the Wrong Contract?

2

2016: A Tale of Two Walls

2

2016: A Tale of Two Walls

2

An Impossible Trinity?

2

An Impossible Trinity?

2

Regulating Psychopaths

2

Regulating Psychopaths

2

Investment Letter - Constant Reformation

2

Investment Letter - Constant Reformation

2

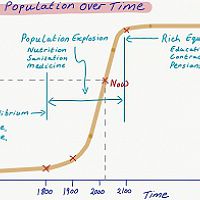

Luddites and the New Social Revolution

2

Luddites and the New Social Revolution

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

The Anxiety Machine - The end of the world isn't nigh

2

The Anxiety Machine - The end of the world isn't nigh

2

While Stocks Last - Reflections on the share buyback debate

2

Register for Updates

12345678

-2

While Stocks Last - Reflections on the share buyback debate

2

Register for Updates

12345678

-2