Loading...

5th January 2021

“It doesn't matter how beautiful your theory is, it doesn't matter how smart you are. If it doesn't agree with experiment, it's wrong.” - Richard Feynman

In October, we wrote about Leon Festinger’s study of a doomsday cult in 1950’s America, and how the cult members were able to repeatedly lie to themselves about why their prophecies kept failing to come true. One of the striking aspects of Festinger’s research, which we did not mention in October, is how closely it accords with the work of Thomas Kuhn, another great behavioural researcher. Kuhn’s work is responsible for the term ‘paradigm shift’, his 1962 book ‘The Structure of Scientific Revolutions’ is considered one of the most influential publications of the twentieth century. Kuhn studied the process of scientific discovery and the behaviour of scientists, especially during periods of scientific paradigm shifts, when the scientific community is in the process of discarding one set of beliefs or theories in favour of new improved theories. We believe Kuhn’s ideas are relevant today for assessing the quality of the scientific advice governments are following in responding to the COVID-19 pandemic.

In October, we wrote about Leon Festinger’s study of a doomsday cult in 1950’s America, and how the cult members were able to repeatedly lie to themselves about why their prophecies kept failing to come true. One of the striking aspects of Festinger’s research, which we did not mention in October, is how closely it accords with the work of Thomas Kuhn, another great behavioural researcher. Kuhn’s work is responsible for the term ‘paradigm shift’, his 1962 book ‘The Structure of Scientific Revolutions’ is considered one of the most influential publications of the twentieth century. Kuhn studied the process of scientific discovery and the behaviour of scientists, especially during periods of scientific paradigm shifts, when the scientific community is in the process of discarding one set of beliefs or theories in favour of new improved theories. We believe Kuhn’s ideas are relevant today for assessing the quality of the scientific advice governments are following in responding to the COVID-19 pandemic.

The conventional view of how science works is known as the Baconian method. Scientists are supposed to observe how the world works – perform experiments, make observations and collect data – and then to formulate theories and build models which describe and explain their observations. They are then supposed to use those models to predict new behaviour and test their models against the new predicted behaviour. If the new observations are found to conflict with the theory’s predictions the theory should then be modified to fit the data.

The Baconian method describes science as an iterative process, continually refining and improving models based on new experimental evidence. The vital element of the Baconian method is the supremacy of experimental confirmation. If a theory cannot be refuted with experimental evidence, it is said to be unfalsifiable and therefore unscientific. If it disagrees with experimental evidence, it is said to be wrong.

The Baconian method describes an idealised, perfect, version of science. The real behaviour of science and scientists, as described by Thomas Kuhn, often differs sharply from this ideal.

One of Kuhn’s most important findings was recognising how scientists often invert the relationship between theory and data. They often become overly protective of their own ideas, to the point where they become unable to look objectively at new experimental data which contradicts them. As a result, once a theory is adopted, scientists tend to look for the supporting evidence and ignore the contradictory evidence. The scientists themselves are usually unaware of this bias. In other words, scientists are human and, like the rest of us, suffer from confirmation bias.

Kuhn found that status, ego and reputation were important impediments to scientific discovery, especially when the scientists in question were leaders of their field. Scientific leaders often have so much personal standing invested in their beliefs they find it impossible to acknowledge when their theories have been disproven. This, Kuhn explained, is why it is often interested outsiders or younger scientists, with little established commitment to the prevailing wisdom, who can often look at scientific problems more objectively.

One of the most striking aspects of Kuhn’s work was his explanation of how the scientific theories – the paradigms – of experts influenced how they interpreted data. Two experts possessing two different views of the world are often able to draw entirely different conclusions from the same set of observations. Kuhn drew much of his insight from his study of how the heliocentric theory of Copernicus, in which the Earth orbits the Sun, overthrew the earlier geocentric theory of Ptolemy, in which the Sun orbits the Earth. When an adherent of the Ptolemaic theory looks up at the night sky they would have seen pinpricks of light on the inside of a celestial dome turning about the Earth. But now, after Copernicus, when we look at the night sky we see a fixed cloud of stars, scattered through space, appearing to move because the Earth is itself turning. In both cases the data, the image of the night sky, is exactly the same but the interpretation of the data is wildly different. The next time you are staring at a stary night sky, try to get your brain to interpret the stars as specks of light on the inside of a dome. It takes a few minutes for the dome to pop into view, but when it does so it is quite breath-taking to see the night sky as people did before Copernicus.

Kuhn’s description of the behaviour of scientific experts confronted with data and theories which challenge their world view, was not flattering. He observed, at first the conflicting data is ignored, then it is called into question, derided and, if possible, discredited. Those promoting ideas challenging orthodoxy are often ostracised from the scientific community and subjected to ad hominem attacks.

When the conflicting data becomes too obvious to ignore and too difficult to discredit incumbent experts fall back on their last line of defence which is to complicate their own theories. They try to redefine the data and build arguments explaining why the data is only a special case requiring only some new, minor, ad-hoc correction to their theory. If their theory is genuinely wrong then, over time, the number and variety of ad-hoc fixes will proliferate until, to the outside observer, the whole body of knowledge becomes incomprehensible and discredited. The symptoms of a bad theory is one where the supporting narrative keeps changing, becoming ever more complicated, and the reinterpretation of data becomes more extreme.

According to Kuhn, once a scientist makes up their mind it is very rare for new evidence to change their mind. Science is not a process of data driving opinions rather it is a process of new experts, with better ideas, displacing existing experts with discredited ideas. In the words of Max Planck: “A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die and a new generation grows up that is familiar with it. . . . An important scientific innovation rarely makes its way by gradually winning over and converting its opponents: it rarely happens that Saul becomes Paul. What does happen is that its opponents gradually die out, and that the growing generation is familiarized with the ideas from the beginning: another instance of the fact that the future lies with the youth.” Or the shorter version: “Science progresses one funeral at a time.” This insight is important when seeking scientific advice. If your advisor is publicly committed to a particular theory, the advice you get will be determined by that theory and it will not change regardless of changing evidence. To get alternate advice you will either have to change advisors or do as Max Planck suggested and wait for nature to take its course.

For readers interested in the insights of Thomas Kuhn and his description of how science often goes awry see chapter two of Fixing Economics (apologies for the egregious plug). Chapters three to six describe how Kuhn’s analysis is confirmed by the stories of respectively: the Copernican revolution, William Harvey’s discovery of circulatory blood flow in animals, Charles Darwin’s discovery of evolution and Alfred Wegener’s theory of continental Drift. The point being, Kuhn’s critique of science is universal, the problems he found occur time after time and are universal to all disciplines.

Perhaps the single most important insight of Kuhn was his recognition of how a scientist’s model of the world can blind them to new ideas and new data. A good model can lead a scientist to new insights, but a bad model can actively prevent new insights and blind them to the truth. It is therefore important to remember it is never possible to ‘follow the science’ because there never is a single science. The best we can do is to recognise we are always ‘following a science’ and to continually ask ourselves if we are following the best available science. Science is, after all, the process of continually questioning the wisdom of experts.

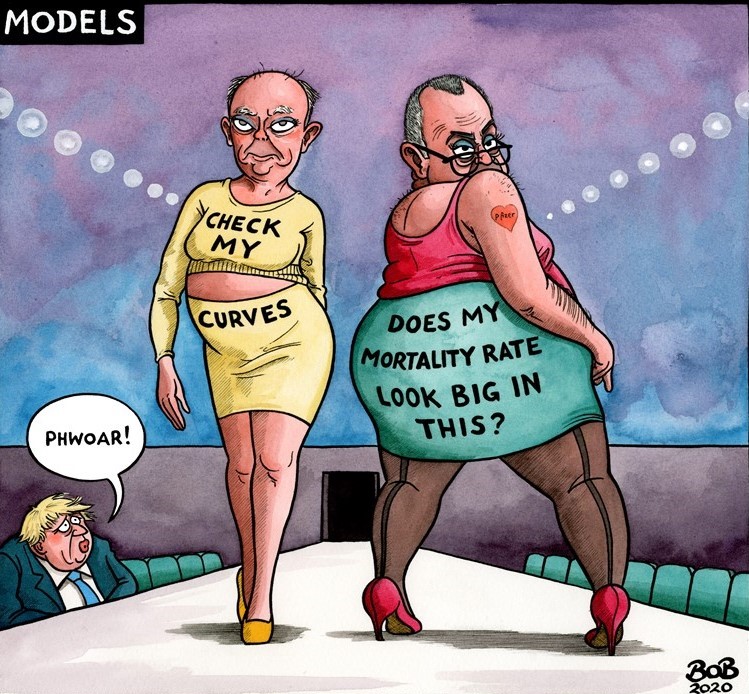

In developing its response to the COVID-19 virus, the British government has relied heavily on the advice of its scientific advisory committee, SAGE – Scientific Advisory Group for Emergencies. Over the course of the crisis the pronouncements of this committee have changed markedly in a way which closely and worryingly follows the pattern of scientific failure described by Thomas Kuhn. Although the SAGE committee is unique to the British government, we believe its advice has been widely influential in framing the response to the COVID-19 crisis globally and is therefore worthy of close examination.

Early in the crisis, before the nature of the COVID-19 virus was well understood, the committee committed itself to a position that the COVID-19 virus represented an extremely dangerous pandemic, comparable in severity with the 1918-19 pandemic known as Spanish Flu. This position was set out in a paper co-authored by one of SAGE’s most prominent members:

“The global impact of COVID-19 has been profound, and the public health threat it represents is the most serious seen in a respiratory virus since the 1918 H1N1 influenza pandemic.”

Having stated that COVID-19 represents an extreme pandemic the paper then goes on to commit to a policy response:

“We find that that optimal mitigation policies (combining home isolation of suspect cases, home quarantine of those living in the same household as suspect cases, and social distancing of the elderly and others at most risk of severe disease) might reduce peak healthcare demand by 2/3 and deaths by half. However, the resulting mitigated epidemic would still likely result in hundreds of thousands of deaths and health systems (most notably intensive care units) being overwhelmed many times over. For countries able to achieve it, this leaves suppression as the preferred policy option. We show that in the UK and US context, suppression will minimally require a combination of social distancing of the entire population, home isolation of cases and household quarantine of their family members. This may need to be supplemented by school and university closures,”

Fortunately, it has now become clear that COVID-19 does not represent a threat comparable to the Spanish flu, but having so publicly committed their reputations to that position, the committee, as Kuhn might have anticipated, has been unable to row back from their original stated position. Instead, they have followed the Kuhnian pattern of behaviour and sought to shift their narrative and redefine the incoming data in a way that best supports their prior theory. Perhaps the most extreme of all these defensive measures has been the reclassification of healthy people as asymptomatic COVID-19 cases, coupled with a choice of testing regime seemingly designed to maximise the number of such asymptomatic cases.

As interested observers of the science behind the COVID-19 crisis, who happen to have spent some time studying the work of Thomas Kuhn, we are concerned to the point of alarm over the quality of advice from the SAGE committee.

Our suggestion, to avoid future committees of scientific advisors falling into the trap we believe SAGE is currently in, is to make a clear distinction between the development of scientific opinion and the oversight of that opinion. Government scientific advisors should be charged with assessing the quality and validity of independent experts and also with sourcing and weighing potentially contradictory opinions. They should not be charged with developing those opinions themselves, as doing so entails a loss of objectivity. This would help avoid the reputations of the committee members becoming entangled in the nature and quality of the advice itself. This structure would, we believe, serve policymakers better by ensuring the committee had the ability to change their position when necessary. In short, we would recommend the SAGE group become disinterested adjudicators of the scientific advice of others rather than advocates of their own ideas.

We appreciate this note is not directly related to the topic of investment. However, as we enter a second year of economic lockdown, we feel it is our duty to engage with the debate over the policy response to COVID-19. A continuation of current policies or a future repeat of these policies would, in our opinion, be a grave mistake having serious adverse economic, social and healthcare implications.

If you would like to join our mailing list please send us a message at info@Equitile.com

Build a company on prudence and trust, not debt

2

Build a company on prudence and trust, not debt

2

2016: A Tale of Two Walls

2

2016: A Tale of Two Walls

2

Revival of the Fittest

2

Revival of the Fittest

2

Tales of an Astronaut - Lessons from the Unknown

2

Tales of an Astronaut - Lessons from the Unknown

2

Modern Monetary Theory - The Magic Money Tree

2

Modern Monetary Theory - The Magic Money Tree

2

Lockdown: What did we get? Why did we do it?

2

Lockdown: What did we get? Why did we do it?

2

Luddites and the New Social Revolution

2

Luddites and the New Social Revolution

2

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

Facts not Opinions

2

Facts not Opinions

2

The Anxiety Machine - The end of the world isn't nigh

2

The Anxiety Machine - The end of the world isn't nigh

2

John Authers of the Financial Times in conversation with George

2

John Authers of the Financial Times in conversation with George

2

Monetary Policy on a War Footing

2

Monetary Policy on a War Footing

2

Hanging the Wrong Contract?

2

Hanging the Wrong Contract?

2

While Stocks Last - Reflections on the share buyback debate

2

While Stocks Last - Reflections on the share buyback debate

2

A creditable recovery

2

A creditable recovery

2

Regulating Psychopaths

2

Regulating Psychopaths

2

Revolutionary Fervour

2

Revolutionary Fervour

2

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

Hedonism and the value of money - Part I

2

Hedonism and the value of money - Part I

2

Debtonator - How Equity Can Work for All of US

2

Debtonator - How Equity Can Work for All of US

2

Money, Blood and Revolution

2

Money, Blood and Revolution

2

0

0

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

Public Deficits, Private Profits

2

Public Deficits, Private Profits

2

Investment Letter - Eternal Adaptation

2

Investment Letter - Eternal Adaptation

2

When Prophecy Fails - How to ignore doomsday forecasts

2

When Prophecy Fails - How to ignore doomsday forecasts

2

Hedonism and the value of money - Part II

2

Hedonism and the value of money - Part II

2

No Hard Promises - thoughts on inflation after COVID-19

2

No Hard Promises - thoughts on inflation after COVID-19

2

Is it time to rethink monetary policy?

2

Is it time to rethink monetary policy?

2

In Search of Stability & Growth - If only Europe was more like the US

2

In Search of Stability & Growth - If only Europe was more like the US

2

An Impossible Trinity?

2

An Impossible Trinity?

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

The Lost Shield? - The small print in Trump's tax plan

2

Register for Updates

12345678

-2

The Lost Shield? - The small print in Trump's tax plan

2

Register for Updates

12345678

-2