Loading...

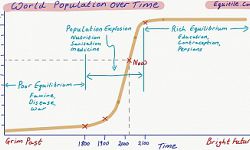

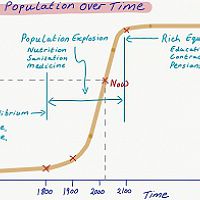

Here at Equitile we have been spending a lot of time on our Longevity Project, studying demographics and the challenges of investing through the next phase of the demographic revolution. We are pleased to say our studies have left us more optimistic.

Equitile's CIO, George Cooper, looks at the year ahead and sees the risk of a bubble in mega-cap technology stocks bursting.

George Cooper, our Chief Investment Officer, suggests central banks are causing rather than curing inflation.

Equitile's CIO, George Cooper, questions the outlook for the US dollar in the light of recent geopolitical events and US bank failures.

Andrew McNally, looks at the latest Silicon Valley phenomenon, ChatGPT. An AI driven chatbot which brings Artificial Intelligence into the mainstream and might well be one of the most distruptive developments of 2023.

We look back to a seminal political speech from 1974 to understand the role that governments themselves might play in the current inflation environment.

In this Investment Letter, George Cooper reflects on how the biblical jubilee celebrations were associated with debt forgiveness. Although not as predictable in today's society, debt forgiveness is still very much at play, through inflation.

In this Investment Letter, George Cooper pays tribute to his late dog, Barney, by using "Barney’s P curve" to describe a universal characteristic of all government macroeconomic policy intervention.

In this letter, George Cooper argues monetary policy within the Eurozone is shifting from a hard-currency tradition, inherited from the German Bundesbank, towards a more "flexible policy" that has historically been more typical of Southern Europe. This shift in ECB policy has so far gone relatively unnoticed, but we suspect its long-term impact will be significant.

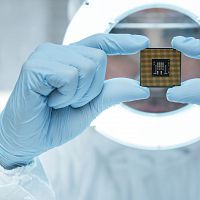

In this Investment Insights letter, George Cooper explains the process of how to make silicon chips while also drawing some parallels with how Equitile invests.

In this insights letter George Cooper illustrates how Kuhn’s ideas are relevant today for assessing the quality of the scientific advice governments are following in responding to the COVID-19 pandemic.

In this note we explain why fiscal deficits are good for equity investors by using the Kalecki profit equation.

Equitile's Chief Investment Officer, George Cooper, joins Tim Price and Paul Rodriguez for their State of the Markets podcast.

George Cooper provides some useful hints for how to spot and when to ignore false doomsday prophecies.

Will the COVID-19 lockdowns prove deflationary or inflationary?

A detailed look at the outlook for inflation after the COVID-19 crisis.

Equitile's Chief Investment Officer, George Cooper, looks at some of the investment implications arising from new habits having formed for both people and companies due to the lockdown.

Equitile's Chief Investment Officer, George Cooper, outlines some of Equitile's thinking on the longer-term implications of the economic shutdown associated with the COVID-19 pandemic.

Equitile's Chief Investment Officer, George Cooper, provides a Fund update regarding the global COVID-19 pandemic.

Equitile's Chief Investment Officer, George Cooper, looks at the history of companies with record breaking market capitalisations, with some useful lessons for investors.

Equitile's Chief Executive Officer, Andrew McNally, looks back on the origins of our investment philosophy and how they have helped us navigate five years of political turmoil and technology driven economic growth.

Are share buybacks necessarily a bad thing? We reflect on the debate, look at the evidence and ask what they mean for investors.

The world’s biggest equity investor has indicated it now expects to reallocate up to $100 billion from European equities into U.S. equities. We think this is the right decision.

After a rocky start, Chairman Powell and President Trump now appear to be on the same policy page.

Low interest rates are supposed to stimulate economic activity. Very low interest rates are supposed to stimulate economic activity even more. This linear thinking, which dominates monetary policymaking, is now being questioned.

Those arguing the case for Modern Monetary Theory are starting to be heard. Our Chief Investment Officer explains, however, why its advocates are presenting no more than the infamous Magic Money Tree.

The strong performance of the US economy relative to Europe tells us much about asset allocation between the two regions and offers an interesting segue into to the UK’s political crossroads.

Why we believe yesterday’s speech by Fed Chairman Powell is positive for the stock market and signals a new, more sophisticated, approach to central banking

Why we believe October’s correction is more about crowd behaviour than economic fundamentals.

George Cooper explains how pension assets should be invested and why recent attempts to ‘de-risk’ pension schemes are causing systemic risks in the pension system as a whole.

George Cooper looks at our cognitive bias towards overly dramatic, overly negative narratives and why the facts, most often, paint a different picture.

Our Chief Investment Officer, George Cooper, explains why chasing dividend yield can lead to a portfolio of yesterday’s corporate losers and tomorrow's corporate failures.

George Cooper looks at why equity markets are performing so well, despite rising interest rates, and explains why the inflation protection offered by equities may become more valuable.

We are hard-wired to prefer predictable environments but our craving for certainty often gets the better of us. One unusual profession, however, might offer some valuable lessons for all investors.

In light of the Financial Conduct Authority’s recently published Asset Management Market Study, Equitile’s CIO George Cooper discusses how the asset management industry could be encouraged to police itself better.

In an evolving, innovative economy it is important to have an adaptive investment strategy. Our CIO, George Cooper, discusses some of the qualities we look for in the companies we invest in and some of the qualities we seek to avoid.

With UK home ownership in decline and the dream of widespread share ownership now just that, Equitile's CEO writes for CapX on the implications for the public policy debate.

Why do we have a crisis in economic theory? Equitile's Chief Investment Officer to share his perspectives at the Cambridge University Marshall Society.

In the heat of the presidential debate, few would have noticed one proposal on the Trump campaign trail that, if put into practice, would be a game-changer. Equitile explores the potential impact of an important footnote to the President-Elect's tax plans.

George Cooper reflects on the lessons of the year passed and muses on what may lie ahead. With Donald Trump just days away from the US Presidency, this year the exercise feels more worthwhile than ever before.

Corporate longevity is in secular decline while we, on average, are living longer. As new firms uproot the old at an increasing rate, Equitile asks what this means for a traditional buy-and-hold investment approach.

Financial markets are pricing higher profits and a higher cost of borrowing while voters expect higher wages. Is this Trump’s impossible trinity?

In this second part George argues the investment climate is getting tougher with bonds priced to deliver especially disappointing returns. However, equities should still comfortably outperform income growth over coming decades.

In the first part of his latest two-part investment letter George Cooper goes back to the Swinging Sixties to offer a few thoughts on hedonism and the value of money in order to explain why inflation is a poor measure of investment success.

Modern economics needs to embrace a new way of looking at and understanding the world if financial crises are to be prevented in the future. George Cooper talks to Juliette Foster at Share Radio about his new book 'Fixing Economics'.

Quantitative easing is only stimulating asset markets, not the real economy, says George Cooper, CIO at Equitile Investments in Bloomberg Interview.

Equitile's Chief Investment Officer, George Cooper, talks to Bloomberg Radio on the underlying causes of the "electoral revolt" seen in the EU referendum.

As corporate debt levels around the world continue to rise Andrew McNally explores some new work in theoretical finance that suggests companies might not be as in control as we thought.

In his second investment letter Equitile's Chief Investment Officer, George Cooper, looks at the deep-rooted causes of Brexit and asks what the implications are for investors navigating a new socio-economic order.

Andrew McNally explores whether a fairer fee model, one that rewards managers for investment success, might lead to a more sustainable active investment management industry and mitigate some of the external costs associated with passive investing.

George Cooper writes for International Banker magazine on why monetary policy needs a serious rethink.

Central bankers are bordering on irresponsible behaviour, by forcing debt into economies, that will ultimately cause deflation says Equitile's Chief Investment Officer, George Cooper.

Equitile's Chief Executive Officer, Andrew McNally, writes in the Financial Times on why the Panama Affair creates a golden opportunity for the UK funds industry.

In their inaugural Investment Letter, George Cooper and Andrew McNally show how Equitile's unique investment approach works in practice and explain why they launched the Equitile Resilience Fund.

In an article for MoneyWeek, Andrew McNally examines what makes a company resilient and allows it to survive and thrive in a fast changing and uncertain world.

In both Westminster and the City PQE has been greeted with a combination of astonishment and derision. George Cooper writes for The Independent on why it might not be as crazy as some commentators suggest.

Andrew McNally, in an article for Moneyweek, looks at the value of financial prudence in corporations and how trusting relationships with customers might depend upon it.

No politician talks about why companies create so much debt. Andrew McNally, writes for Prospect Magazine on why a change to the tax treatment of interest expenses in corporations should be on the political agenda.

Many of the principle-agents problems in corporations, although often seen as an equity problem, might in fact be down to excessive reliance on debt finance.

In a light-hearted view look at the crisis in economic thinking, George Cooper presents at Nudgestock: The world’s only cool behavioural finance conference.

George Cooper talks to World Finance on the crisis in economic thinking as explored in his second book, Money, Blood and Revolution.

Tim Haig explores George’s vision of a simplified model of economic systems and the engine of prosperity.

In his book, Debtonator, Equitile's Chief Executive Officer, Andrew McNally, looks at the risks posed by excessive corporate debt and how greater use of equity might be better for everyone.

A two part interview with John Authers of The Financial Times about Money, Blood and Revolution.

At Equitile we believe it is impossible to understand either macroeconomics or financial markets without first understanding the role of money and debt in the economic system.

George Coopers speaks to Ross Ashcroft of The Renegede Economist on the scientific revolution in which economics and finance now finds itself.

Andrew McNally writes for the Daily Telegraph on the declining use of equity finance and how our reliance on debt to fund future growth is a source of extreme wealth inequality.

Politicians of all shades seem united on one thing at least: the need for banks to keep lending. Since the financial crisis, getting credit flowing has been the main goal of financial policy. Equitile's Chief Executive Officer, Andrew McNally, writes for the Financial Times on why they might be missing a more creditable solution.

Economics is a broken science, living in a kind of Alice in Wonderland state believing in multiple, inconsistent, things at the same time. In his second book George Cooper examines the scientific revolution in which economics now finds itself.

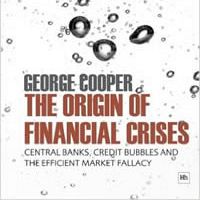

In a series of disarmingly simple arguments George Cooper challenges the core principles of today's economic orthodoxy and explains how we have created an economy that is inherently unstable and crisis prone.

Crisis Economics

2

Crisis Economics

2

Why ownership matters more than ever

2

Why ownership matters more than ever

2

A creditable recovery

2

A creditable recovery

2

Hedonism and the value of money - Part II

2

Hedonism and the value of money - Part II

2

While Stocks Last - Reflections on the share buyback debate

2

While Stocks Last - Reflections on the share buyback debate

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Meerkats and Market Behaviour - Thoughts on October's stock market fall

2

Is corporate debt addictive?

2

Is corporate debt addictive?

2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

Still Flashing Green: Equities in a world of higher growth and financial repression

2

Investment Letter - Eternal Adaptation

2

Investment Letter - Eternal Adaptation

2

Is it time to rethink monetary policy?

2

Is it time to rethink monetary policy?

2

Seductive Charm

2

Seductive Charm

2

Hedonism and the value of money - Part I

2

Hedonism and the value of money - Part I

2

Depressed lobsters and the dividend yield trap

2

Depressed lobsters and the dividend yield trap

2

An interview with World Finance

2

An interview with World Finance

2

Build a company on prudence and trust, not debt

2

Build a company on prudence and trust, not debt

2

An Impossible Trinity?

2

An Impossible Trinity?

2

The Origin of Financial Crises

2

The Origin of Financial Crises

2

Modern Monetary Theory - The Magic Money Tree

2

Modern Monetary Theory - The Magic Money Tree

2

Investment Letter - Constant Reformation

2

Investment Letter - Constant Reformation

2

Facts not Opinions

2

Facts not Opinions

2

Norway Moves to America - Mean reversion and industrial revolutions

2

Norway Moves to America - Mean reversion and industrial revolutions

2

Undoing the Mistakes of QE

2

Undoing the Mistakes of QE

2

Money, Blood and Revolution

2

Money, Blood and Revolution

2

Revival of the Fittest

2

Revival of the Fittest

2

In Search of Stability & Growth - If only Europe was more like the US

2

In Search of Stability & Growth - If only Europe was more like the US

2

Lumbering corporate dinosaurs face mass extinction

2

Lumbering corporate dinosaurs face mass extinction

2

Debt & the magical mathematics of Brahmagupta

2

Debt & the magical mathematics of Brahmagupta

2

The Lost Shield? - The small print in Trump's tax plan

2

The Lost Shield? - The small print in Trump's tax plan

2

Hanging the Wrong Contract?

2

Hanging the Wrong Contract?

2

Reckless Prudence - How to break a pension system

2

Reckless Prudence - How to break a pension system

2

Regulating Psychopaths

2

Regulating Psychopaths

2

The Anxiety Machine - The end of the world isn't nigh

2

The Anxiety Machine - The end of the world isn't nigh

2

The unspoken political truth about debt

2

The unspoken political truth about debt

2

'Fixing Economics' by George Cooper: Book Review

2

'Fixing Economics' by George Cooper: Book Review

2

Can fair fees make active managers more sustainable?

2

Can fair fees make active managers more sustainable?

2

Captain Kirk and the science of economics

2

Captain Kirk and the science of economics

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

A New Maestro? Observations on an important speech by Fed Chairman Powell

2

Debtonator - How Equity Can Work for All of US

2

Debtonator - How Equity Can Work for All of US

2

Tales of an Astronaut - Lessons from the Unknown

2

Tales of an Astronaut - Lessons from the Unknown

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

Over Easy - Can Monetary Policy Become Self-Defeating?

2

John Authers of the Financial Times in conversation with George

2

John Authers of the Financial Times in conversation with George

2

Monetary Policy on a War Footing

2

Monetary Policy on a War Footing

2

Panama Papers create a golden opportunity for UK fund houses

2

Panama Papers create a golden opportunity for UK fund houses

2

2016: A Tale of Two Walls

2

Register for Updates

123

-1

2016: A Tale of Two Walls

2

Register for Updates

123

-1